Americans are leading double lives when it comes to money — seemingly flush with cash and confidence on the outside, but shivering with financial fears on the inside. This is the sobering conclusion from Nonfiction Research in its report, “The Secret Financial Lives of Americans and the Future of Financial Services.”

More than 2,200 consumers were surveyed for the massive 117-page report, including interviews with banking executives (and even one bank robber). Researchers concluded that the usual indicators of people’s financial status — where they live, where they vacation, what they shop for, and what you see on their social media accounts — send misleading signals. Financial marketers that aren’t careful can quickly find themselves pointed in the wrong direction.

The research also revealed that many Americans are financing the visible parts of their lives by draining their savings and running up debt. They need help, but many mainstream institutions seem to either feel it isn’t their job, or that they can’t make money by getting involved. “Staggering numbers of Americans are leading double lives when it comes to money,” the report said. “To their friends and neighbors their lives look normal, even prosperous. But privately, behind closed doors, Americans are badly in need of help with money and the emotions that surround it.”

Indeed, almost no mainstream institutions offer the kinds of services and help that people most need to straighten out their financial lives. Third-party budgeting apps are only one small part of the solution to growing financial distress among large numbers of U.S. consumers. But savvy financial marketers will look at the situation and see opportunities to ask, “Where can we step in and help?”

One way to understand how Americans wrestle with finances is to hear about the things they didn’t do specifically because they were worried about money, the report says.

For instance, one heart-wrenching example from the survey verbatims:

“I was given tickets to the second-to-last game ever played at the old Yankee Stadium. I couldn’t take my son because I didn’t even have the money for two hot dogs, a couple of sodas, and a box of Cracker Jacks.”

“Because these behaviors are often invisible — none show up in store sales, pricing models, common survey responses, or attendance numbers — they’re too often missed by conventional research,” Nonfiction Research warns.

Americans’ Self-Inflicted Financial Wounds

Nonfiction Research also points out that large numbers of Americans fall under the sway of social media lifestyle expectations, often spending money they don’t have to be able to make themselves look better off than they really are. 28% of Millennials admit to intentionally making themselves look wealthier in their social media posts.

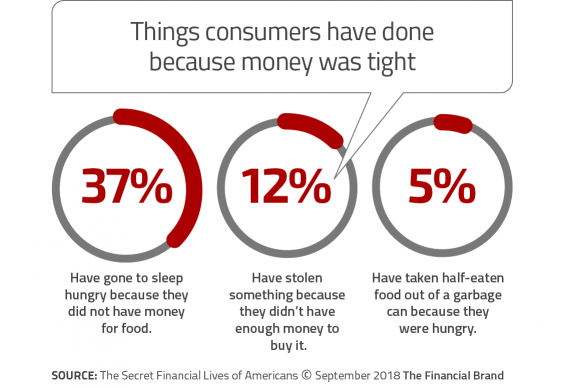

At the same time that Americans are spending more money on travel and real estate, and spending more time on social media, the report notes, their finances are being eviscerated, which their friends can’t see. That situation leads to statistics like this:

Visible financial indicators are booming:

- Travel revenue is up.

- Real estate investment is up (and has surpassed stocks as the best performing asset class).

- The number of images posted to social media is soaring, many showing off travel and new “things.”

But privately, financial indicators are sagging:

- Savings rate is at an all-time low.

- Almost twice as many Americans have credit cards (76%) as have retirement accounts (47%).

- Almost 20 million Americans have a shopping habit that jeopardizes their relationships or careers.

- American credit card debt hit an all-time high of $1.02 trillion in January 2018.

- 44% of Americans couldn’t handle a $400 emergency without borrowing.

- 33% of non-retired Americans have nothing at all saved for retirement.

- 71% of Americans are stressed by money.

The Nonfiction Research survey quantifies similar observations drawn by the Center for Financial Services Innovation’s U.S. “Financial Diaries” project. The seven-year research, a joint venture with New York University, followed the lives of 235 middle- and low-income families and individuals over the course of a year and described in detail the financial distress of many consumers.