Personal Finance Employee Education Fund

PFEEF provides support to organizations and their employees as they attend to and take charge of their financial well-being. Organizations that provide financial education to their employees show results that include improvement in workplace productivity, employee morale, and loyalty while reducing absenteeism, turnover, workplace distractions and stress. Our four areas of focus are:

1. Financial Wellness and Literacy Programs that empower employees to learn more about personal finance and to become better managers of their own personal well-being. This, in turn, helps organizations create a more productive, healthy, and profitable workforce.

2. The Personal Financial Wellness Scale™ (PFW), which is a reliable measurement of perceived financial well-being/financial distress.

3. The Business of Personal Finance: How to Improve Financial Wellness. Book by Joseph Calandro, Jr. and John Hoffmire.

4. The PFEEF Wisconsin Project. PFEEF via the FinLit website provides free online financial literacy courses for Wisconsin employers to help their employees and members learn more about how to manage their personal finances.

PFEEF’s Financial Wellness and Literacy Programs

PFEEF provides online modules for employee financial education that provide unbiased instruction in personal finance, investment, and retirement fundamentals. They focus on topics such as learning how to budget and save; interest (how to have it work for you rather than against you), as well as understanding how to begin early to plan for retirement.

The Personal Financial Wellness Scale™ (PFW Scale™)

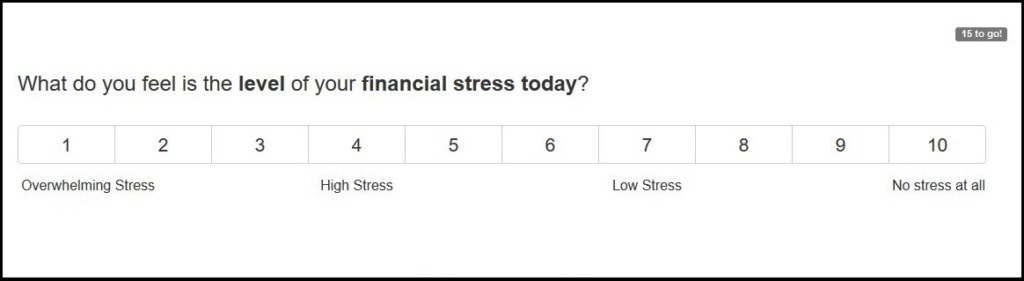

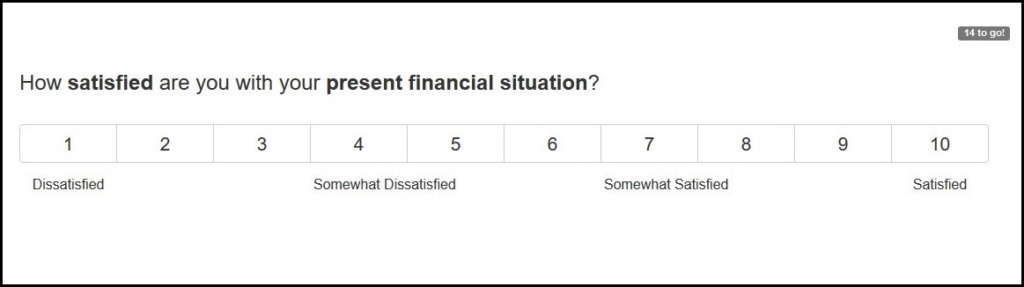

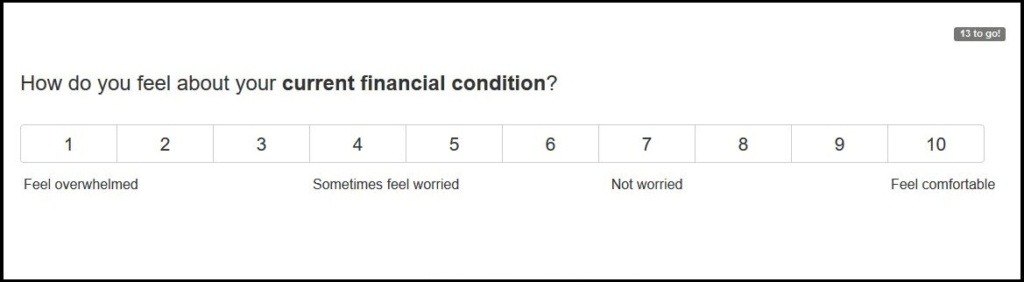

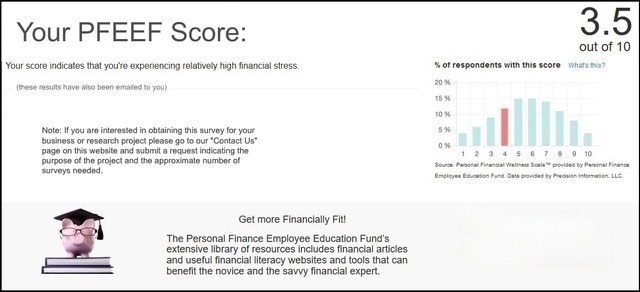

The PFW Scale™ is an eight item survey, which is a reliable measurement of perceived financial distress/financial well-being. It provides the user with a score, which has been scientifically determined to be a valid and reliable measure of one’s perceived personal financial wellness, as well as measure for employees learning progress during the financial literacy programs.

The Business of Personal Finance: How to Improve Financial Wellness

Book by Joseph Calandro, Jr. and John Hoffmire

Fun to read, the book leverages core corporate financial principles in a way that helps people become more financial literate in their personal lives. The premise of this book — that personal and corporate finance can and should be learned together to improve financial wellness and know-how — is considered a breakthrough.

Promoting Financial Wellness for all Employers and Employees

PFEEF was established in 2006 by Dr. E. Thomas Garman. The organization advocates best practices in workplace financial programs to increase employee well-being and employer profits.